One of the leading purposes of politics is to deepen our knowledge and understanding of the most powerful forces operating by individuals, communities, and corporations today that have an influence in the U.S. and around the world. Understanding politics and the insulation industry’s involvement is valuable for all citizens.

As representatives of Local 2, we do not endorse any particular political party but do endorse candidates who are good for the insulation industry and Local 2, whether they are republican, democrat, or independent. House Bill No. 23 (HB-23) offers an equitable and forward avenue of how politics effectuate our industry. In exciting news, Local 2 along with the other Pennsylvania locals, retained services to get HB-23 sponsored and the process rolling to be passed. Our leaders and representatives from our contractor’s association have gone to Harrisburg to speak at hearings to get this bill passed into law. Here are the most important details of the bill and how it will benefit our industry in the future:

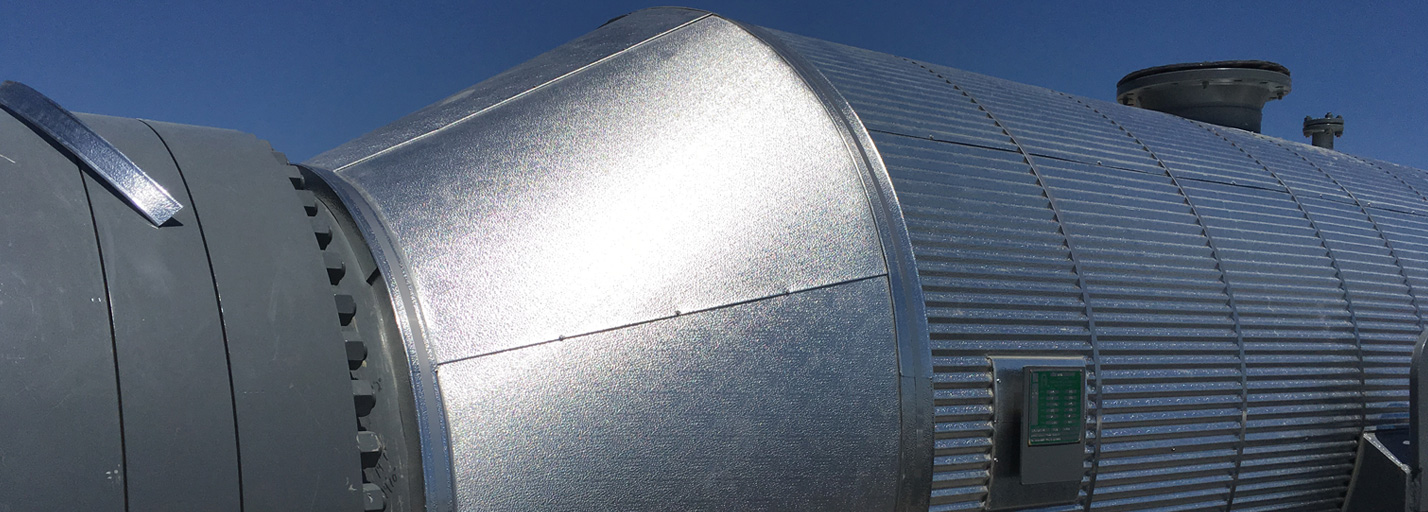

HB-23 offers a tax incentive to businesses that upgrade mechanical system insulation. This relates to the tax credits for the installation of mechanical insulation using the minimum, American Society of Heating, Refrigerating and Air-Conditioning Engineers, (ASHRAE) standard for shovel-ready, cost-saving, and energy-saving projects. The purpose of this helps to motivate owners, developers, and contractors to advance these methods.

Each fiscal year, $5 million in tax credits will be made available to The Department of Revenue of the Commonwealth, or known as the department, to be awarded, and the tax credit will be equal to no more than 30% of the total capital investment for the installation of mechanical insulation on commercial or industrial property within this Commonwealth for the applicable taxable year.

Total capital investment includes all or more of the following:

- Amounts paid during the taxable year for the purchase of mechanical insulation that is installed on the commercial or industrial property.

- Labor costs paid that are properly allocable to the preparation, assembly, and installation of mechanical insulation on the commercial or industrial property during the taxable year.

A qualified taxpayer may apply to The Department of Revenue of the Commonwealth for a tax credit through a form prescribed by the department and will include the following:

- Information required by the department to document the total cost of the capital investment for the installation of mechanical insulation on a commercial or industrial property

- Information required by the department to verify the applicant is a qualified taxpayer.

- Any other information as the department deems appropriate.

After submitting the form and adhering to The Department of Revenue of the Commonwealth processes, the department will review the application for the tax credit and issue an approval or disapproval to the applicant. Upon approval, the department will issue a certificate stating the amount of tax credit granted to the qualified taxpayer.

In claiming the tax credit, the qualified taxpayer may claim a tax credit against the qualified tax liability for the taxable year in which the capital investment was made. Please note, the tax credit may be applied against up to 50% of the qualified taxpayer’s qualified tax liability for the taxable year. Other important things to note when this bill passes include:

- A tax credit awarded under this bill may not be sold, assigned, or transferred.

2. A tax credit awarded under this bill may not be carried back, carried forward, or used to obtain a refund.

At the end of the first year of HB-23 passing and awarding tax credits, and each Oct. 1 thereafter, the department will submit a findings report on the tax credit. This includes the names of the qualified taxpayers utilizing the tax credit as of the date of the report and the amount of tax credits approved for and utilized by each qualified taxpayer.

The power of politics and passing HB-23 can help position Local 2 and other locals for better, sustainable, and financially smart business practices for the future. As insulators, Local 2 members, and U.S. citizens, we should always be informed and empowered to make the best, educated decisions that effectuate our industry. Through proactive opportunities, the possibilities for our industry evolve, amend, and pivot towards greatness.